Portfolio Guarantee Scheme

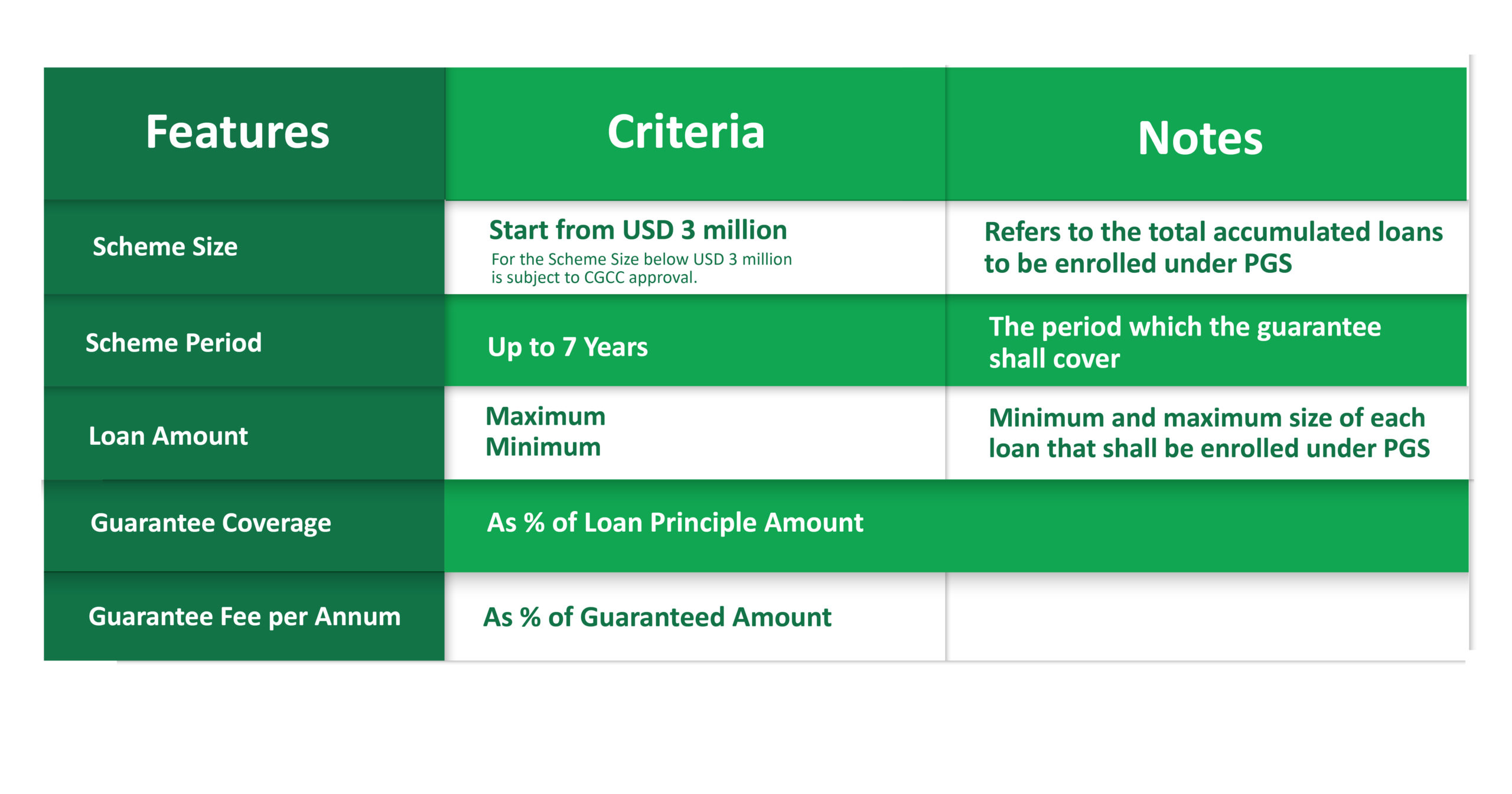

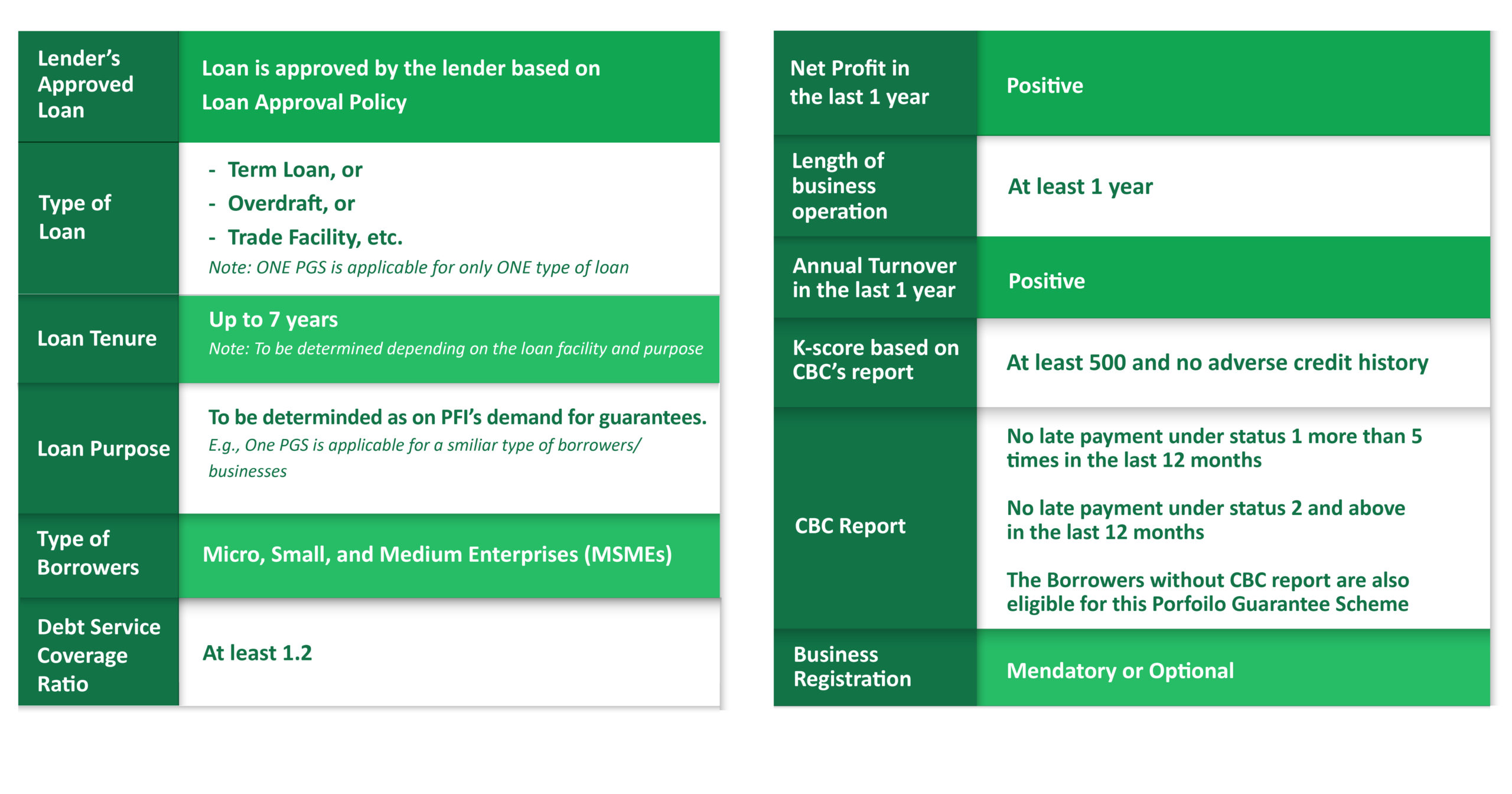

The Portfolio Guarantee Scheme (PGS) is the credit guarantee scheme offered by the CGCC. PGS is a credit guarantee scheme under which Guaranteed Loan criteria are pre-agreed by CGCC and PFI to enable the PFI to enroll multiple loans in PGS without having to get guarantee approval on each loan from CGCC prior to loan disbursement. PGS is suitable for multiple loans with similar characteristics and for PFIs that are familiar with CGCC and vice versa.

Click here to download: PGS General Guidelines