Business Recovery Guarantee Scheme

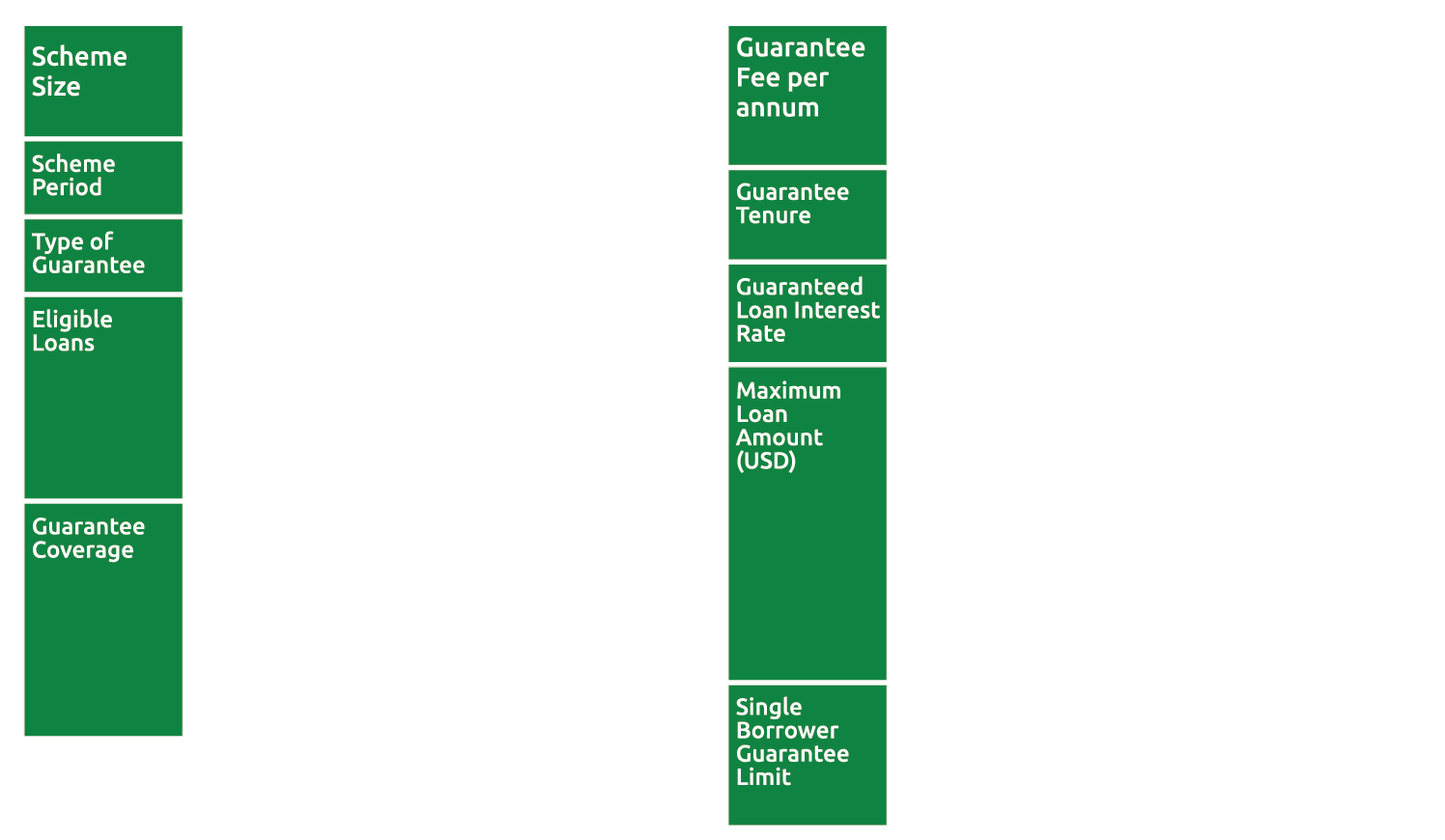

The Business Recovery Guarantee Scheme (BRGS) is the first credit guarantee scheme offered by the Credit Guarantee Corporation of Cambodia Plc. (CGCC).

BRGS aims to support businesses including Micro, Small and Medium Enterprises (SMEs) and Large Firms to enhance their access to formal loans for both working capital and investment or business expansion. BRGS is in line with the policies of the Royal Government of Cambodia to support the survival and economic recovery during the COVID-19 pandemic.

BRGS acts as collateral/security for 70%-80% of the loan amount borrowed by businesses from the Participating Financial Institutions (PFIs); thus, reducing the physical collateral required from the borrowers.