CGCC extends credit guarantee to more financial institutions

ខែមិថុនា 30, 2021ព័ត៌មានថ្មីៗ

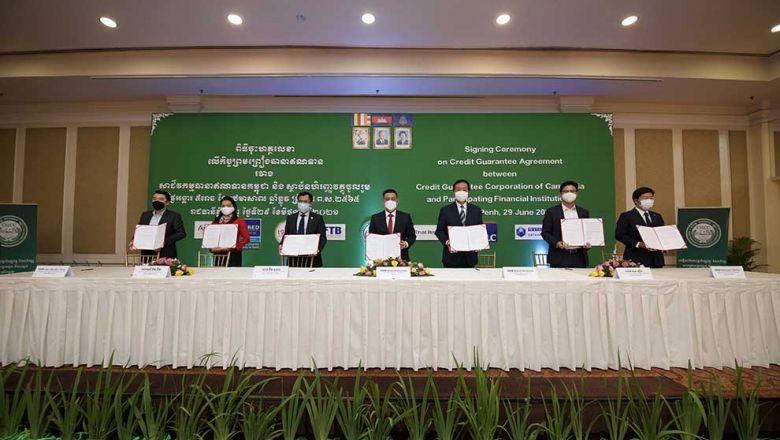

The Credit Guarantee Corporation of Cambodia (CGCC) has signed a credit guarantee agreement with a second batch of participating financial institutions (PFIs) comprised of (in alphabetical order) Amret Micro-Finance Institution (MFI), BRED Bank, Camma MFI, Foreign Trade Bank of Cambodia, J Trust Royal Bank, LOLC MFI and Sathapana Bank. This increases the total number of CGCC PFIs to 15.

The signing enables the CGCC and PFIs to collaborate on disbursing guaranteed loans to businesses in Cambodia.

The increased number of CGCC PFIs will provide borrowers with a more diverse choice of financial institutions across the country to seek financing under the corporation’s guarantee scheme. CGCC supports PFIs in disbursing loans to borrowers who are deemed able to repay them but lack collateral, by providing 70 to 80 percent guarantees that take the place of traditional collateral.

Secretary of State of the Ministry of Economy and Finance and Chairman of CGCC’s board of directors Ros Seilava said: “The credit guarantee mechanism is a new financial service in Cambodia that is expected to help resolve the financing challenges and bring [a] new lending culture to banks and microfinance institutions. I would like to encourage the PFIs to seize the opportunity of partnering with CGCC to expand [their customer bases] and market segments through the provision of new loans with the guarantees from CGCC. At the same time, to reap the long-term benefits of this credit guarantee scheme, it is very critical for the PFIs to adhere to professionalism and strengthen the governance on credit assessment and monitoring.”

CGCC launched the $200 million Business Recovery Guarantee Scheme (BRGS) in March 2021 to support businesses including micro, small and medium enterprises, as well as large firms, to enhance their access to formal loans from the PFIs for working capital, investment and business expansion.

The scheme is available until the end of 2022 and the guaranteed loans will be disbursed through the PFIs on a “first-come, first-serve basis”. So far, 18 guarantees have been issued to PFIs under the BRGS.

Eligible borrowers may approach the PFIs for the CGCC’s guarantee scheme or contact it directly via its website www.cgcc.com.kh for more information.

The 15 CGCC’s PFIs include (in alphabetical order) ACLEDA Bank, AMK MFI, Amret MFI, Asia Pacific Development Bank, BRED Bank, Cambodia Post Bank, CAMMA MFI, Canadia Bank, Foreign Trade Bank of Cambodia, J Trust Royal Bank, LOLC MFI, Phillip Bank, Prince Bank, RHB Bank and Sathapana Bank.