Co-Financing Guarantee Scheme (CFGS)

The Co-Financing Guarantee Scheme (CFGS) is the second credit guarantee scheme offered by the Credit Guarantee Corporation of Cambodia (CGCC). CFGS is specifically designed for the loans disbursed under the SMEs Co-Financing Scheme Phase II of the SME Bank of Cambodia. CFGS is an additional facility to the SCFS II for risk-sharing with the PFIs on loans disbursed under SCFS II.

CFGS aims to support Small and Medium Enterprises (SMEs) to enhance their access to formal loans for both working capital and investment or business expansion. CFGS helps the PFIs to disburse more unsecured loans and supports SMEs to borrow more than they otherwise can without CFGS. CFGS is in line with the policies of the Royal Government of Cambodia to support the survival and economic recovery during the COVID-19 pandemic.

Click here to read : the official document of CFGS guidelines

CFGS Scheme Features

Eligible Borrowers

For loans to be qualified for the CGCC’s guarantee scheme, the borrowers must fall into the following criteria:

- The Borrower must be a majority Cambodian-owned SMEs (>50% shares).

- The Borrower must produce a business registration issued by appropriate government authorities.

- The Borrower who is a non-registered SME must proceed with the registration after the guarantee is approved. If the borrower remains a non-registered SME, an additional guarantee fee of 0.5% per annum of the guaranteed amount will be imposed on every anniversary of the guarantee.

- All Borrowers should be financially viable.

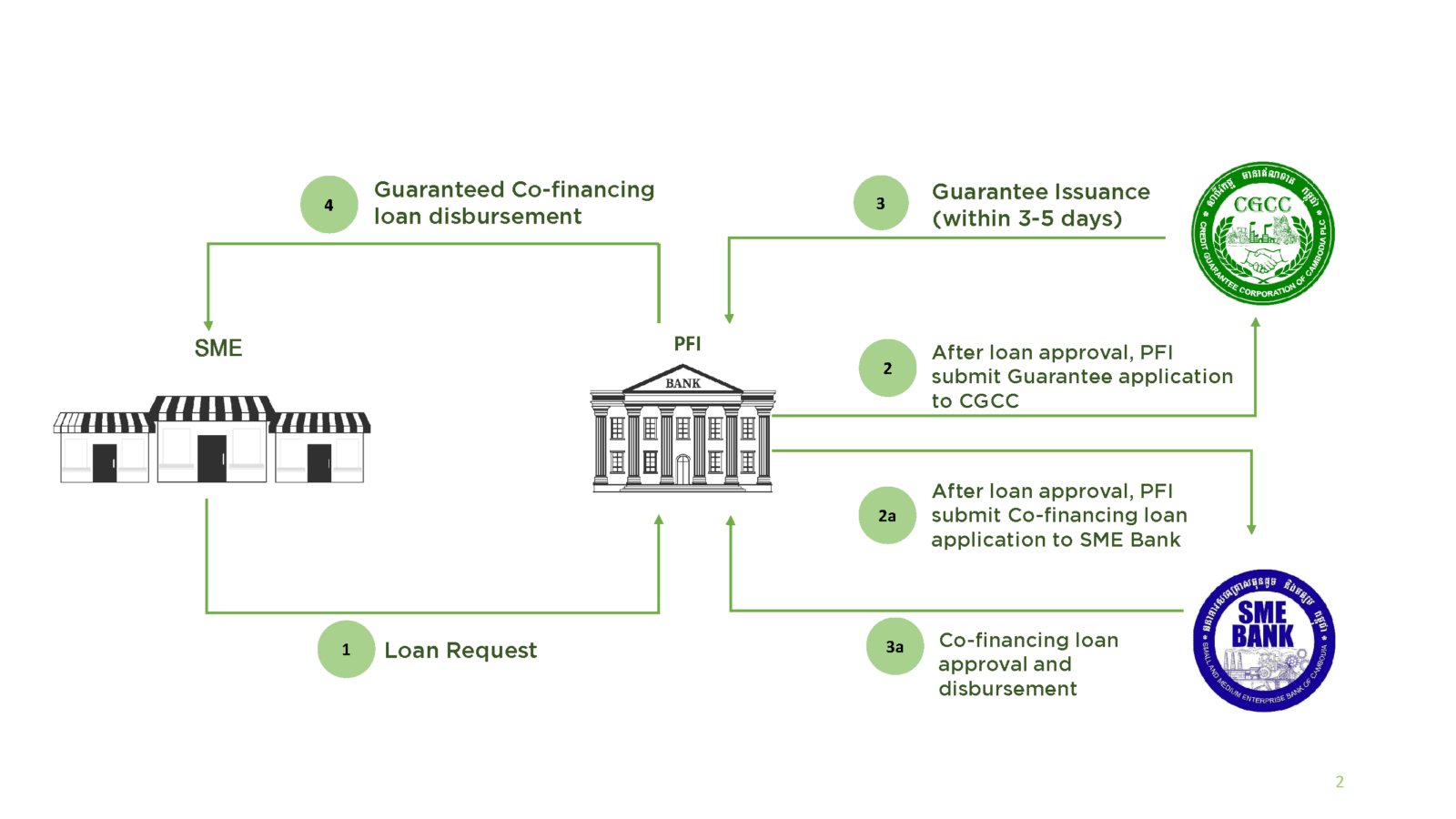

How to apply for CFGS?

1.SME borrowers need to apply for a loan under SCFS II from any mutual Participating Financial Institutions (PFIs) of CGCC and SME Bank of Cambodia.

2.After approving the loan using their own appraisal method, PFIs shall submit the Guarantee Application Form to CGCC for guarantees not more than 60 days from the approval date.

3.CGCC shall review the loans and Guarantee Application to decide whether to approve the guarantee or not. In the case the guarantee is approved, CGCC shall issue a Letter of Guarantee and billing to the PFIs.

4.PFIs shall disburse the guaranteed loans to borrowers after the Letter of Guarantee is issued and the co-financing loan drawdown is approved by the SME Bank of Cambodia. In case the co-financing loan drawdown is rejected by the SME Bank of Cambodia, the Letter of Guarantee issued by CGCC will become invalid.

Click here to read about Business Recovery Guarantee Scheme

CFGS Process Flow

Benefits of CFGS

- 1. Supporting SMEs survival and economic recovery during the COVID-19 pandemic in line with Government's policies.

- 2. Acting as collateral/security for 70%-80% of the loan amount borrowed from the PFIs, making SMEs more bankable.

- 3. Helping SMEs access to financing and improving financial inclusion in Cambodia

- 4. Sustaining SMEs operation during COVID-19 outbreak and providing capital investment for business expansion

- 5. Serving as a policy tool for long-term growth of SMEs

- 6. Diversifying and sharing risks with PFIs, allowing more loans to be approved for SMEs

Small & Medium Enterprise (SME)

CFGS aims to support Small and Medium Enterprises (SMEs) to enhance their access to formal loans for both working capital and investment or business expansion. CFGS helps the PFIs to disburse more unsecured loans and supports SMEs to borrow more than they otherwise can without CFGS. CFGS is in line with the policies of the Royal Government of Cambodia to support the survival and economic recovery during the COVID-19 pandemic.

Click here to understand about Guarantee Progress